Vid Hribar

Strategic Partnerships and Ecosystems Manager

Blockchain Hub, Raiffeisen Bank International AG

Despite the big potential of tokenization, the only tokenized assets that have truly found a product-market fit so far are stablecoins. In this article, we will explore their history, characteristics, growth, risks, potential use cases, and the role of banks.

Let’s start from the beginning: what is a stablecoin?

Stablecoins are blockchain-based tokens that represent a stable real-world asset, such as a currency or commodity. When referring to stablecoins, the most commonly discussed type is currency-backed stablecoins. These stablecoins are typically pegged to a specific fiat currency, such as the US dollar, and aim to maintain a stable value relative to that currency.

However, there are also other types of stablecoins, such as commodity-backed stablecoins (e.g., Pax Gold backed by gold), crypto-backed stablecoins (e.g. DAI backed by Ether), or even unbacked/algorithmic stablecoins (e.g. UST, which should maintain the peg through an algorithm – however, we have seen that this might not be the case on the example of algorithmic stablecoin UST which crashed, causing almost 18 billion dollars to be lost in a matter of days). In the case of the biggest stablecoins nowadays, the backing is in currency-denominated assets such as bank deposits and short-term treasury bonds (low-risk, highly liquid assets).

History

The concept of stablecoins originated from the need for a stable digital asset in the cryptocurrency market. In 2014, BitUSD became the first stablecoin, addressing the demand for a reliable unit of value for trading cryptocurrencies without having to exchange cryptocurrencies to fiat money. As the crypto market expanded, more stablecoins appeared. Notable examples include USDT (issued by Tether) and USDC (issued by Circle). Facebook’s Libra project, later renamed Diem, aimed to create a global stablecoin but faced heavy regulatory backlash and halted the project completely.

Growth of stablecoins

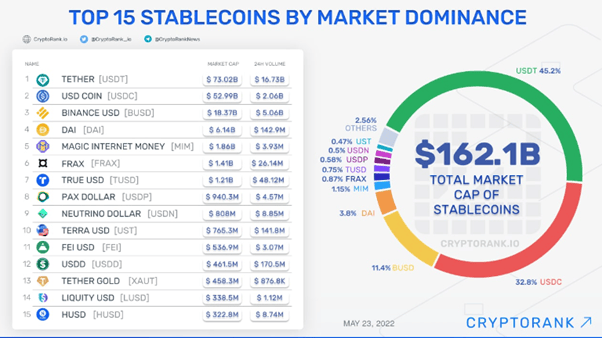

In recent years, stablecoins have experienced significant growth, with a current market capitalization of around $125 billion. This growth can be attributed to their utility in cryptocurrency trading and decentralized finance (DeFi) applications. However, most stablecoins are currently tied to the value of USD. In the near future, it is expected that more EUR stablecoins will emerge due to the regulatory clarity provided by MiCA (Markets in Crypto Assets Regulation, entered into force in June 2023 and enters into application in June 2024), which also regulates stablecoins. Another driver for EUR stablecoins is the positive interest rate environment. As the issuer has to back the stablecoin with deposits or other assets, a positive interest rate contributes to a positive business case for the issuer.

Use cases for stablecoins

Stablecoins could theoretically support a wide range of use cases, including treasury payments, FX and trade finance, merchant payments, and more. However, in practice, their primary use case remains within the realm of cryptocurrency trading and DeFi protocols, providing traders with a stable asset to mitigate market volatility.

There is also a potential use of stablecoins in emerging markets, where they are used to store value due to high inflation, and for cross-border payments – offering a faster and more cost-effective alternative to traditional remittance services.

Stablecoins could also facilitate micro-payments and support new business models by providing programmable money in the future. Stablecoins could also be integrated into the Internet of Things (IoT) ecosystem, enabling seamless machine-to-machine transactions. Nevertheless, stablecoins can only support such applications, and it will take some time for these use cases to mature.

Banks and other players in the financial industry can play a role in the stablecoin ecosystem by either becoming processors for existing stablecoins or issuing their own stablecoins. Some recent examples of engagement in this space include

- Moneygram processing USDC to distribute UNHCR (United Nations High Commissioner for Refugees) donations in Ukraine

- Visa testing how to settle payments in USDC

- SAP testing cross-border payments for businesses using stablecoin

- KBC issuing Kate Coin (a digital coin based on blockchain)

- and Societe Generale Forge (a subsidiary dedicated to digital assets) launching CoinVertible, a Euro-denominated stablecoin

Risks of stablecoins

Stablecoins also come with certain risks, and it is always important to know what stablecoins are backed by. The lack of transparency in regard to the assets backing the stablecoin has raised concerns. For example, Tether (issuer of USDT) faced scrutiny regarding the transparency of its reserves and settlement. After being fined by US regulators, Tether moved towards more transparency by publishing regular reserve reports. Circle (issuer of USDC), on the other hand, was more transparent from the beginning in relation to the composition of its reserves. However, recently, when Silicon Valley Bank faced troubles, it was revealed that Circle had $3.3 billion of cash reserves in that bank. The market reacted to the news, and the stablecoin lost almost 14% of its value until the money was transferred to another bank. Other risks include software vulnerabilities and regulatory compliance, as jurisdictions worldwide are still developing clear guidelines for stablecoin issuance and operations.

While banks seem to understand that the potential of stablecoins is significant, finding the first widespread use case outside of the crypto space has proven challenging. Nevertheless, banks are in a good position to capture a significant portion of the stablecoin market, especially in EUR stablecoins, due to the trust they have from their customers and the expertise they have developed in payments. Many developments in the EUR stablecoin market await us in the next two years, where banks will help shape the new market.